by Jill Greenwood

Business & Industry Connection (BIC)

The concept of hitting the goal of “Net Zero by 2050” has been a call to action for climate activism for years and has become a guiding principle in determining investment protocols in the social, corporate and governance worlds.

“Net zero” was mentioned in more than 6,000 filings with the U.S. Securities and Exchange Commission (SEC) in 2022 and countless other times by publicly traded corporations and investor groups in statements and on their websites. The SEC said its proposed climate disclosure rule will help investors “evaluate the progress in meeting net-zero commitments and assessing any associated risks.”

In a recent column from Steve Milloy, a senior fellow with the Energy and Environment Legal Institute, the Wall Street Journal noted that “net zero” and its corollary, the “energy transition,” are “talked about so often and so loosely that many take them for granted as worthy goals that could be accomplished with greater buy-in from political and business leaders.”

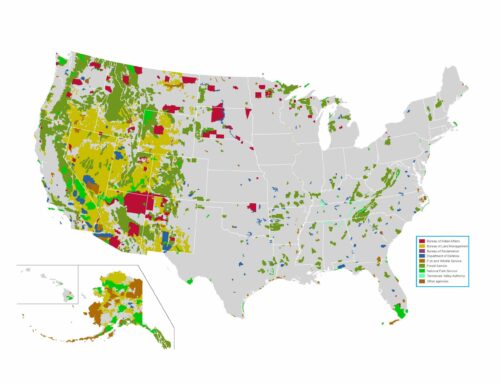

Two new energy reports show the U.S. is burdening and dismantling its grid to achieve an impossible goal, Milloy said.