by H. Sterling Burnett

The Heartland Institute

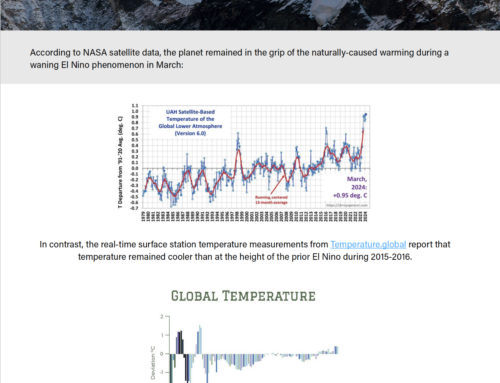

The Biden administration is pushing a range of policies across various regulatory agencies to force companies, pension fund managers, and portfolio funds to account for and divulge climate-related risks, in their disclosure statements, stock offerings, annual reports, and other public documents…

With marching orders from Biden and Harris in hand, the U.S. Securities and Exchange Commission (SEC) has created a 22-member Climate and Environment, Social, and Governance (ESG) Task Force to enforce the administration’s social justice and climate change goals. Simultaneously, the SEC issued a call for public comments for a rule requiring publicly traded corporations, investment management firms, and mutual funds under its regulatory purview to disclose the climate-change-related risks and opportunities they might face. This public disclosure would include a thorough description of how their business operations, legal proceedings, management discussions and decisions, and financial conditions might be affected by climate change and how the companies are responding to any potential risks uncovered.

The Competitive Enterprise Institute (CEI) assembled and submitted formal comments in response to the SEC’s climate risk disclosure proposal. Multiple organizations endorsed and signed on to CEI’s comments, including the Caesar Rodney Institute, the Committee for a Constructive Tomorrow, the CO2 Coalition, the Energy and Environment Legal Institute, FreedomWorks, The Heartland Institute, The Heritage Foundation, the National Center for Public Policy Research, 60Plus, and the Texas Public Policy Foundation. The coalition’s comments provide a thoroughgoing refutation of the idea that companies can realistically anticipate and accurately report the magnitude and probability of the financial losses they could incur due to the physical impacts of climate change.