by Steve Milloy, E&E Legal Senior Policy Fellow and Junkscience.com Founder

As Appearing in the Wall Street Journal

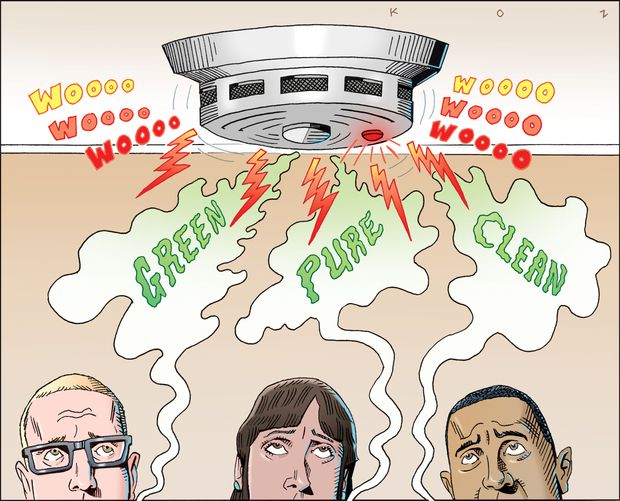

Companies tout their work on climate change in their filings but mislead the public about their impact.

Climate-change partisans on both sides often accuse one another of dishonesty. Here’s a suggestion for resolving that dispute in at least one important corner of the world—publicly owned companies.

Securities laws are built on disclosure and antifraud measures. Although climate isn’t a special circumstance that requires unique disclosure rules, during the Obama years the Securities and Exchange Commission issued guidance to companies for making climate-related disclosures. The guidance focused mainly on disclosing risks to business operations and profitability either from extreme weather or climate regulation.

As a result of the guidance, corporate SEC filings now routinely make banal reference to future risks from climate change. But in recent years companies have also turned climate change from a disclosed risk into a marketing opportunity.

Companies often tout what they are doing to “save the planet” or “combat climate change.” None of these claims are tethered to reality, much less securities laws. Here are some examples, not intended to pick on any one company. Apple claims it is “significantly reducing emissions to address climate change.” But Apple’s claimed CO2 emissions amount to a mere 0.04% of the global total of 53.5 billion tons.

Exxon Mobil pats itself on the back for playing an “essential role in addressing the risks of climate change” by cutting its operational emissions by 20 million tons last year. What the company doesn’t mention is that during the same period, Exxon Mobil sold products that when burned let out close to 600 million tons of emissions.