by Katy Grimes, Senior Media Fellow and California Globe Editor

As appearing in the California Globe

California could be facing a serious real estate crisis if homeowners insurance is not available

The number of California’s rural homeowners dropped by insurance companies is up to nearly 350,000 in just four years, the Fresno Bee reported this week. But what is not addressed is that without the ability to properly insure the home, many homeowners say their homes are rendered worthless because they cannot sell them. All mortgage companies require real estate property owners to carry homeowners insurance.

California Globe recently talked with residents of Chico who are experiencing this latest crisis following deadly wildfires: “Homeowners insurance is also becoming a huge problem with existing homeowners. Anthony said his homeowners insurance was just cancelled out of the blue. He reported many other’s whose homes were not burned down are being notified of cancellations as insurance companies are telling customers they are no longer offering insurance in the wildfire areas.”

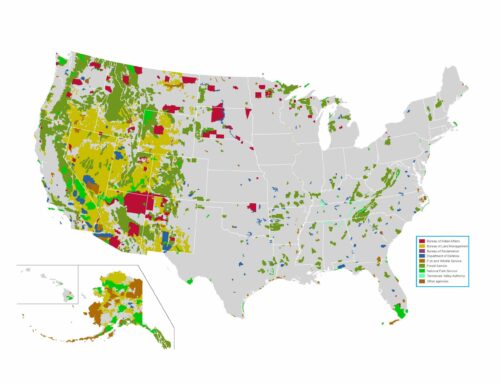

My husband and I were notified yesterday that our homeowners insurance was being cancelled immediately on a home we own in El Dorado County – far from the recent wildfires, but in national forestland. Our insurance plan even had a $65,000 deductible for fire.

One resident of Chico told California Globe he received homeowners insurance quotes as high as $9,000 per month.